How to Draft a Storage Rental Agreement

- August 18, 2025

- Rentals, Reservations, Storage Host

A storage rental agreement is a formal document that outlines the terms of renting a Read More

Peer storage platforms like PeerStorage ensure trust and security by implementing detailed verification processes for both hosts and renters. Here’s how they do it:

These measures create a secure environment where users can confidently rent or list storage spaces.

Identity verification acts as the first line of defense against fraudulent activity on peer-to-peer storage platforms. By ensuring that every account is tied to a real person or a legitimate business, this process builds accountability and reduces the chances of scams or false representation.

Verification starts as soon as users sign up and continues throughout their activity on the platform. The cornerstone of this process is official identification, which can include driver’s licenses, state-issued ID cards, passports, or military IDs from all 50 states and U.S. territories.

Users are required to submit government-issued IDs, along with their legal name, date of birth, and current address. These details are cross-checked using OCR technology and manual reviews. To prevent misuse, real-time selfies taken via smartphone or webcam are compared with the photo on the submitted ID to confirm authenticity.

For businesses, the process is more comprehensive. Platforms verify Employer Identification Numbers (EIN) through IRS databases, while the business owner or responsible officer must also complete personal identity verification.

The time it takes to verify an identity often depends on the quality of submitted documents. On average, it ranges from 15 minutes to 48 hours, with faster processing for high-quality images and submissions during regular business hours. Submissions made on weekends or holidays might take longer.

Address verification adds another layer of security. Some platforms require users to validate their residential address by submitting utility bills, bank statements, or credit reports dated within the last 90 days. This step ensures users can’t create multiple accounts using fake addresses and confirms their connection to the stated location.

Once identities are confirmed, the collected data is protected by strict security protocols. Platforms rely on advanced encryption measures, such as AES 256-bit encryption, to safeguard sensitive information both during transmission and while stored. This level of encryption is the same standard used by banks and government agencies.

Access to encrypted verification data is limited to authorized personnel who have undergone background checks. While platforms retain verification data for regulatory compliance periods – typically three to seven years depending on state laws – the actual ID images are often deleted after verification is complete. What remains are encrypted records indicating verification status.

Platforms follow data minimization principles, collecting only the information necessary for verification and compliance. For example, Social Security numbers are generally not required unless mandated by anti-money laundering laws. This approach reduces privacy risks by avoiding the collection of unnecessary personal details.

To ensure ongoing security, platforms undergo regular third-party audits to review their technical and data-handling practices.

Users also have some control over their verification data. They can request copies of stored information or, in certain cases, ask for its deletion after their account is closed. However, platforms must balance these requests with legal obligations to retain records for fraud prevention and compliance purposes.

Peer-to-peer storage platforms go beyond basic identity checks by incorporating background and risk assessments. Here’s a closer look at how these platforms ensure user trust and safety.

After verifying a user’s identity, platforms conduct deeper background checks to evaluate trustworthiness. Hosts, who bear more responsibility, undergo stricter screening compared to renters. These checks often focus on offenses related to property – like theft, fraud, or vandalism – as well as violent crimes. Renters, on the other hand, are assessed using criteria suited to their more limited level of access.

Platforms must also comply with federal and state regulations, such as the Fair Credit Reporting Act (FCRA). This means obtaining user consent, providing proper disclosures, and following specific procedures for adverse actions. Background checks typically pull records from multiple jurisdictions, including county, federal, and national databases, to create a well-rounded profile.

For business accounts, verification includes confirming legal standing with state authorities and reviewing the backgrounds of authorized representatives.

To identify potential risks, platforms use algorithms to analyze user behavior and payment patterns. For example, a history of disputed transactions can raise red flags. Digital footprints, such as IP address consistency and account creation behaviors, are also scrutinized to detect signs of fraud.

Behavioral patterns may trigger additional reviews. For instance, users requesting storage for high-value items without an established history or avoiding official communication channels can appear suspicious. Many platforms also participate in fraud prevention networks, enabling them to flag users identified in broader anti-fraud efforts.

Transparency and fairness are key in the screening process. Platforms use consistent standards to avoid arbitrary decisions. They often outline general criteria, specifying which offenses could lead to automatic disqualification and which might be reviewed on a case-by-case basis.

When a background check results in an adverse decision, users are provided with clear written notice. They’re also informed of their rights to dispute inaccuracies. Appeals processes allow users to present additional context or evidence of rehabilitation, ensuring a fair chance to address flagged issues.

To balance security and privacy, platforms retain background records only as long as necessary. Regular audits of screening practices ensure the criteria remain effective without unfairly excluding qualified users. Continuous monitoring after approval helps identify any emerging risks. These measures, combined with payment and property verification systems, form a robust security framework for peer-to-peer storage platforms.

After identity and background checks, the next step in securing transactions is payment verification. This process ensures that every financial transaction is safe by confirming payment methods, reducing fraud risks, and preventing chargebacks. These measures work alongside earlier checks to maintain the platform’s reliability.

Before approving payment methods, platforms often perform pre-authorization. This involves placing a temporary hold – typically between $1 and $5 – on a credit card or bank account. The hold is reversed within 3–5 business days.

For credit cards, platforms verify details like the billing address, CVV code, and card status (e.g., ensuring the card hasn’t been reported lost or stolen). If the method is a debit card tied to a bank account, the platform may also confirm that the account holder’s name matches the user’s verified identity.

For ACH payments, micro-deposit verification is common. The platform sends two small deposits (usually less than $1 each) to the user’s bank account. The user must confirm the exact amounts within 2–3 business days, proving they have legitimate access to the account.

Additionally, platforms use device fingerprinting during payment setup. By analyzing device and network data, they can flag methods previously linked to fraud.

Automated systems are crucial for identifying risky transactions. For instance, large payments or first-time transactions from new users often trigger alerts.

Geographic inconsistencies are another red flag. If someone’s payment method originates in California, but they’re suddenly booking storage in Florida using an IP address from New York, the system flags the activity for review. Similarly, payments from devices in time zones that don’t match the user’s registered location can raise concerns.

Last-minute bookings with new payment methods are especially risky. Fraudsters often use stolen payment details to make immediate purchases, hoping to finish transactions before the theft is detected. To counter this, platforms may require extra verification for same-day bookings from unverified users.

Other automated tools, like velocity checks, monitor transaction patterns to detect unusual behavior and flag it for review.

When it comes to payouts, platforms take additional steps to ensure funds are sent securely to verified accounts. Hosts must provide their Social Security Number (SSN) or Employer Identification Number (EIN), which is cross-checked with their bank account details.

Verification includes ensuring the routing number belongs to a legitimate U.S. bank and that the account can accept ACH transfers. Platforms also confirm that the account hasn’t been flagged in fraud databases and that its format matches the bank’s requirements.

For business hosts, additional documentation like Articles of Incorporation or business registration certificates is required. The names of authorized signatories on the business account must match those verified during the registration process.

Tax compliance is another key component. Hosts earning over $600 annually must submit valid tax identification numbers, and platforms issue 1099 forms as required by the IRS. International hosts undergo further checks, including verification of tax treaty status and compliance with foreign account reporting rules.

To mitigate risks, some platforms impose graduated payout limits for new hosts. For example, initial payouts might be capped at $500 until the host completes additional verification steps and establishes a history of successful transactions. This approach balances fraud prevention with allowing legitimate users to start earning.

Ensuring that storage listings are accurate and trustworthy is key to maintaining a safe and reliable platform. This process confirms that hosts have control over their spaces and that the condition of these spaces matches what’s advertised. By doing so, renters are protected, and the platform’s integrity is upheld.

Before a listing goes live, hosts must provide clear evidence that they have the legal right to offer the storage space. This might include ownership documents or authorization from the property owner. Requiring this proof ensures that only individuals with proper authority can list spaces for rent.

Hosts are required to upload detailed photos showing that their storage space is clean, secure, and free from any damage or leaks. In some cases, platforms may also request a virtual walkthrough to verify the space’s condition and confirm that it matches the description provided in the listing.

Ongoing accuracy is monitored through renter feedback. If discrepancies are repeatedly reported, platforms may step in to request updated photos or additional documentation. This ensures that listings remain consistent with their advertised standards over time.

After verification, platforms must prioritize the protection of data and manage access effectively throughout the rental process.

Peer storage platforms rely on advanced encryption to safeguard communications between users. A key method employed is identity-based encryption (IBE), which verifies user identities and prevents malicious actors from forging or altering ID details to gain unauthorized access.

Here’s how it works: user applications sign access requests with private keys, creating unique digital signatures. These signatures confirm the user’s identity without exposing sensitive personal details. For instance, when a renter messages a host about a storage space or shares payment information, encryption ensures that only the intended recipient can access the message.

Additionally, role-based access controls are in place to limit what users can see or do. Hosts, for example, can only access information about their own listings and renters, while renters are restricted to viewing details related to their inquiries or rented spaces. All data transfers occur over secure, encrypted channels – whether the data is in transit or stored – ensuring consistent protection.

Physical security is just as critical as digital safeguards. Many platforms now use smart lock technology integrated with their verification systems. These smart locks work hand-in-hand with the encryption process, verifying digital signatures to grant or deny access. This seamless integration ensures that only verified renters can physically access the storage spaces they’ve rented, providing an additional layer of security.

Peer-to-peer storage platforms rely on multiple layers of verification to create a secure environment for both hosts and renters. These layers include identity, background, payment, listing, and access checks – all designed to protect users throughout the entire transaction process.

To achieve this, platforms implement thorough user verification while prioritizing data security. Advanced encryption and limited data retention ensure sensitive information stays protected. Silent, real-time address checks add another layer of fraud prevention without complicating the onboarding process for users.

These safeguards not only enhance security but also streamline the experience. Features like pre-authorizations and remote walkthroughs enable faster approvals and smoother transactions. Digital verification tools help match renters and hosts quickly, minimizing potential disputes and ensuring a seamless process.

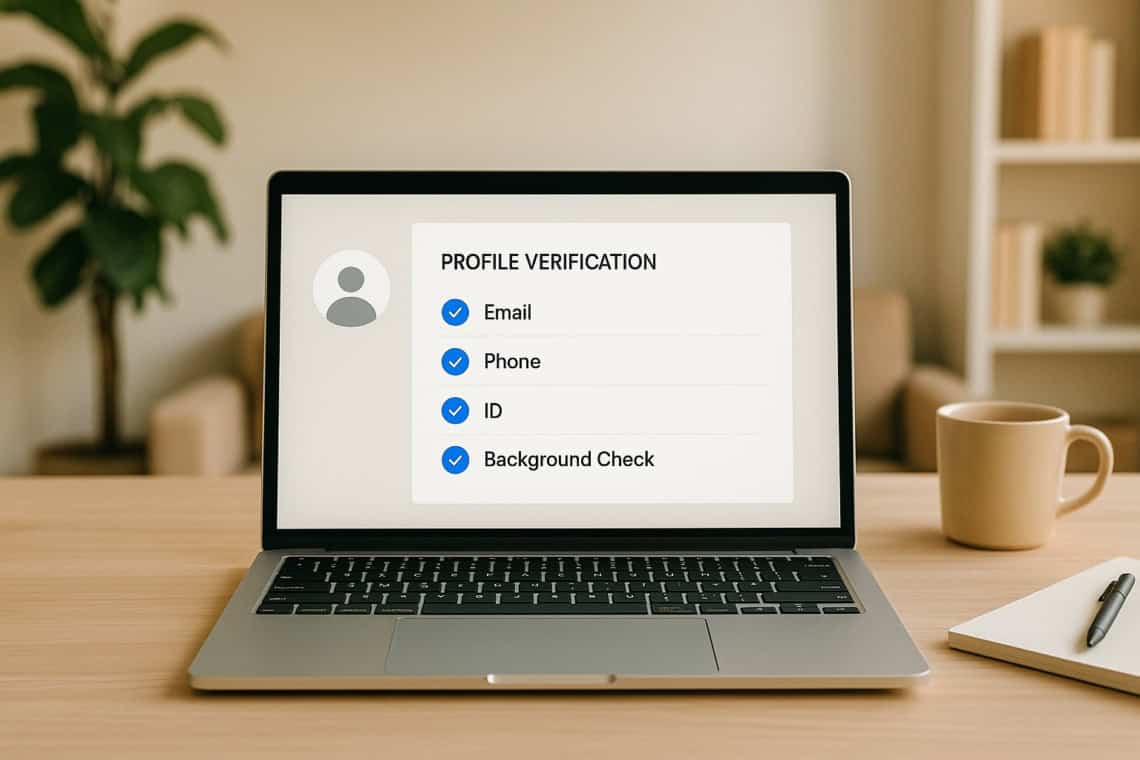

PeerStorage stands out by combining identity, payment, listing, and access verifications with tools like digital signatures and role-based access. By integrating email, phone, government ID, and bank account linking, the platform strikes a balance between robust security and user convenience.

Whether you’re booking or listing, you can trust that every step – from identity verification to secure access – is designed to protect your storage transaction and provide peace of mind.

PeerStorage takes user privacy and data security seriously, implementing advanced encryption to keep information safe. All data is encrypted directly on the user’s device, ensuring it stays private and secure every step of the way.

For identity verification, PeerStorage uses multi-step authentication along with strict verification protocols. These precautions help block unauthorized access and protect user data, creating a secure and reliable experience for both hosts and renters.

PeerStorage goes the extra mile to ensure that storage spaces listed by hosts are legitimate and secure. Hosts must create thorough profiles that include clear and accurate descriptions of their spaces, highlight security features, and outline any relevant policies. On top of that, PeerStorage implements rigorous verification processes to confirm that each listing is authentic and meets established safety standards. These steps are designed to build trust and offer reassurance to both hosts and renters.

PeerStorage handles disputes or concerns about background checks with a clear and transparent resolution process. If a renter suspects an error in their background check, they can submit the issue for review. PeerStorage conducts a thorough investigation to confirm that all information is accurate and current.

By allowing renters to challenge incorrect or outdated findings, the platform ensures a fair process while maintaining the trust and safety of its users. This approach reinforces the reliability of the verification system.

Join The Discussion